IRS Form 2848: Your Guide to Power of Attorney Success

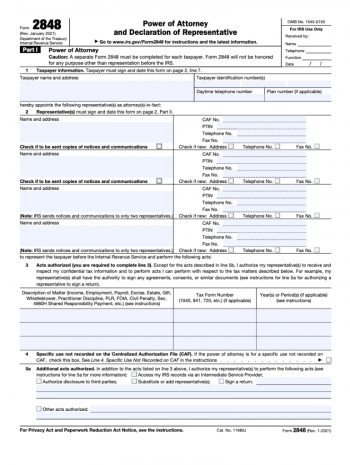

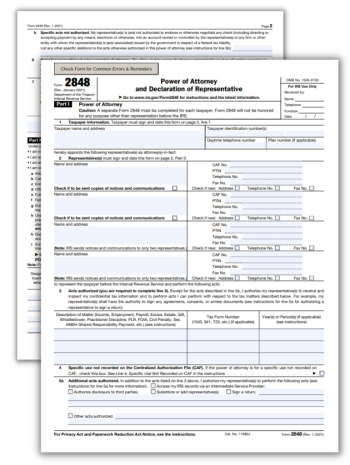

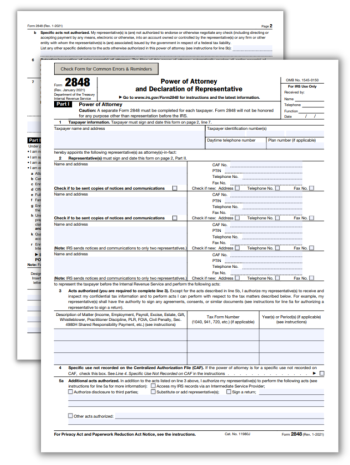

IRS Form 2848, the Power of Attorney and Declaration of Representative, is a document that allows taxpayers to appoint an eligible individual to represent them in matters related to the Internal Revenue Service (IRS). This form is essential when a taxpayer needs assistance from an authorized representative, such as an attorney, Certified Public Accountant (CPA), or Enrolled Agent (EA), especially when dealing with complicated tax situations. A comprehensive guide on using this declaration can be found in the IRS Publication 947 (Practice Before the IRS and Power of Attorney).

Our website 2848-form-fillable.com provides valuable resources to help taxpayers and their representatives complete the attorney declaration accurately. On this platform, users can access the Form 2848 fillable PDF, which simplifies the process of inputting necessary information electronically. Additionally, the website offers a sample of IRS Form 2848, showcasing a correctly filled-out template, which can serve as a useful reference for taxpayers. Furthermore, the website supplies a blank Form 2848 that can be downloaded or filled in online. The combination of these materials, alongside clear instructions and examples, ensures that taxpayers and their representatives can confidently submit a correctly completed Form 2848 to the IRS.

The Form 2848 & Power of Attorney Importance

The document is required to be filed by individuals who need to authorize a third party to represent them before the Internal Revenue Service (IRS). According to the tax form 2848 instructions, this can include taxpayers who cannot handle their return affairs personally or business owners who would like their accountant, attorney, or another authorized representative to act on their behalf.

- Let us consider the case of Susan, a 45-year-old entrepreneur who is going to file Form 2848 online. Susan owns an expanding e-commerce business, which demands most of her time and energy. Due to the hectic schedule and lack of expertise in taxation, she decides to hire an accountant to handle her tax-related matters.

- Susan must fill out the 2848 form to grant her accountant the necessary authorization to represent her before the IRS. This includes discussing and resolving tax-related issues, signing tax returns, and even negotiating settlements on Susan’s behalf. By filing this declaration, Susan ensures that her tax affairs are managed professionally and efficiently.

Form 2848 Instructions to Fill It Out Online

- Begin by carefully reading the instructions provided on our website to gain a thorough understanding of the document and its requirements.

- Collect all necessary documentation, including personal identification, tax identification numbers (TIN), and relevant IRS forms.

- Access the Form 2848 (POA) fillable template on our website and start entering the required information in the designated fields.

- While filling out the template, ensure that all entries are accurate and complete to avoid any errors or discrepancies.

- Review the copy thoroughly before submission, double-checking all entries for any potential mistakes.

- Save a copy of the completed fillable Form 2848 for personal records and possible future reference.

- File the 2848 form fillable electronically, following the provided guidelines for a seamless submission process.

- Remember always to consult trustworthy guidelines or seek professional advice if any questions or concerns arise during the process.

Filing Form 2848 to the IRS

The due date for filing IRS Form 2848 fillable in 2023 depends on the specific tax return or issue for which it is being submitted. Generally, Form 2848 should be filed alongside the corresponding annual return or before the tax matter's deadline. This ensures that the authorized representative has ample time to address the issue on behalf of the taxpayer. In some cases, taxpayers may be granted an extension of time to complete their tax documents, including Form 2848.

IRS Penalization System

Penalties associated with filing Federal tax form 2848 or providing false information may include:

- Monetary fines

Those who willingly provide false information on this document can face significant financial penalties. The exact amount depends on the severity of the offense and the extent to which the IRS was defrauded. - Criminal charges

In cases where the fraudulent filing of Form 2848 is particularly egregious, individuals may face criminal charges, including tax evasion or fraud. Convictions can result in imprisonment, fines, or both (Criminal Investigation (CI) At-a-Glance). - Revocation of representation rights

Tax professionals or representatives who knowingly provide false information on IRS Form 2848 printable risk losing their privilege to represent taxpayers before the Internal Revenue Service. This can significantly impact their careers and reputation in the tax industry ("Circular 230").

Form 2848 Fillable PDF Guide

- How can I access a fillable IRS Form 2848?There is a free editable PDF on our platform, which allows you to complete the sample digitally before printing and submitting it. Alternatively, you can download the blank 2848 PDF and fill it out manually. Both methods ensure that you provide accurate data on the attorney declaration.

- What is the pros of a fillable Form 2848, Power of Attorney?There is no need to look for a place to print the copy or be scared to make a mistake. You can quickly correct the information and share the sample with your representative. Besides, there is an auto-check for errors.

- Where can I get the 2848 form if I need it for my tax filing?Download the PDF directly from our site for free. You can also find the relevant copy at local tax preparation offices, or you can request it by mail from the IRS.

- How do I submit a tax form 2848 PDF to the IRS?You can mail or fax the completed copy to the appropriate IRS office. The address and fax number can be found in the instructions provided with the document. It is crucial to ensure that all necessary data is included and accurate to avoid any delays in processing your power of attorney.

- What happens after I submit my Form 2848 (POA) to IRS?The Internal Revenue Service will review the declaration and if approved, the authorized representative specified in the form will be granted the authority to act on your behalf. The IRS will also send a confirmation notice to both you and the representative, notifying that the power of attorney is in effect.

Form 2848 (POA) Instructions for 2023

-

![image]() Form 2848 Instructions Embarking upon the journey of comprehending the paramountcy of IRS Form 2848 instructions, it is incumbent upon us to delve into the labyrinthine nature of this particular tax document, elucidating its objectives and potential applications in the realm of United States taxation. As an aspiring econo... Fill Now

Form 2848 Instructions Embarking upon the journey of comprehending the paramountcy of IRS Form 2848 instructions, it is incumbent upon us to delve into the labyrinthine nature of this particular tax document, elucidating its objectives and potential applications in the realm of United States taxation. As an aspiring econo... Fill Now -

![image]() Federal Form 2848 Form 2848: A Historical Excursion Traversing the intricate landscape of taxation in the United States necessitates the acquisition of a comprehensive understanding of the variegated forms and documents utilized in this domain, one of which is the federal form 2848. In order to sufficiently elucidat... Fill Now

Federal Form 2848 Form 2848: A Historical Excursion Traversing the intricate landscape of taxation in the United States necessitates the acquisition of a comprehensive understanding of the variegated forms and documents utilized in this domain, one of which is the federal form 2848. In order to sufficiently elucidat... Fill Now -

![image]() IRS Form 2848 Printable Embarking upon the labyrinthine journey of comprehending and effectively utilizing the IRS Form 2848 printable PDF, it is of paramount importance to elucidate the structural components embedded within this document, while simultaneously emphasizing the salient fields that necessitate meticulous atte... Fill Now

IRS Form 2848 Printable Embarking upon the labyrinthine journey of comprehending and effectively utilizing the IRS Form 2848 printable PDF, it is of paramount importance to elucidate the structural components embedded within this document, while simultaneously emphasizing the salient fields that necessitate meticulous atte... Fill Now -

![image]() IRS Form 2848 Example In the multifaceted realm of taxation within the United States, an array of convoluted scenarios often arise, necessitating the utilization of specific tax forms. One such sample, IRS Form 2848, serves as a quintessential example of the complexity involved in the tax filing process. Delving into the... Fill Now

IRS Form 2848 Example In the multifaceted realm of taxation within the United States, an array of convoluted scenarios often arise, necessitating the utilization of specific tax forms. One such sample, IRS Form 2848, serves as a quintessential example of the complexity involved in the tax filing process. Delving into the... Fill Now