Federal Tax Form 2848: How to Effortlessly Grant Power of Attorney

Form 2848: A Historical Excursion

Traversing the intricate landscape of taxation in the United States necessitates the acquisition of a comprehensive understanding of the variegated forms and documents utilized in this domain, one of which is the federal form 2848. In order to sufficiently elucidate the significance and usefulness of this document, it is imperative to embark on a brief historical excursion, delving into the origins of this particular document. Initially instituted as a means to facilitate taxpayers in appointing a qualified representative to act on their behalf concerning federal tax matters, Form 2848 has undergone several modifications since its inception, rendering it a crucial instrument in the realm of taxation.

Key Modifications to Form 2848

As the ever-changing landscape of taxation evolves, so too does the necessity for the adaptation and modification of the forms utilized by the Internal Revenue Service (IRS). In this context, it is of paramount importance to shed light on the key modifications introduced by the IRS, specifically concerning the federal tax form 2848. The most noteworthy of these alterations pertains to the enhancement of the document's clarity and comprehensibility, ensuring that taxpayers and their representatives can seamlessly navigate the complexities of the tax system. Furthermore, the IRS has taken strides in refining the instructions accompanying the document, thus facilitating an expeditious and accurate completion of the document.

Who Can and Cannot Use Form 2848?

In order to optimize the utility of the federal form 2848 power of attorney, it is essential to elucidate the eligibility criteria for those who seek to utilize this declaration. Generally, any individual or entity required to file federal tax returns or engage in other tax-related transactions may avail themselves of the benefits conferred by Form 2848, provided they meet certain qualifications. Key among these stipulations is the requirement for the appointed representative to possess a valid preparer tax identification number (PTIN) and be an attorney, certified public accountant, enrolled agent, enrolled retirement plan agent, or enrolled actuary. Conversely, individuals who do not meet these criteria - such as those not authorized to practice before the IRS or those with a history of disbarment or suspension - are precluded from utilizing Form 2848.

The Potential of Form 2848: Tips for Maximizing its Advantages

For those seeking to harness the full potential of this essential tax document, it is incumbent upon them to follow certain guidelines to maximize the advantages of the federal form 2848 instructions.

- Firstly, one must ensure that the form is completed in its entirety, with all requisite information accurately and legibly provided.

- In addition, it is advisable to thoroughly review the form's provisions, delineating the specific tax matters for which the representative is authorized to act.

- Lastly, retaining a copy of the completed example for one's records can streamline future tax-related transactions, thereby optimizing the overall tax experience.

A comprehensive understanding of Form 2848's historical background, key modifications, eligibility criteria, and utilization strategies is crucial for navigating the complex world of taxation in the United States. By adhering to these guidelines and optimizing the form's advantages, taxpayers can rest assured that their appointed representatives deftly manage their tax matters.

Related Forms

-

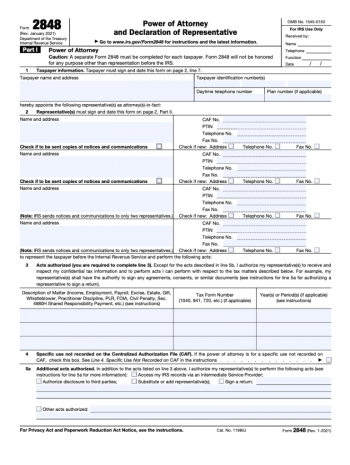

![image]() 2848 IRS Form 2848, the Power of Attorney and Declaration of Representative, is a document that allows taxpayers to appoint an eligible individual to represent them in matters related to the Internal Revenue Service (IRS). This form is essential when a taxpayer needs assistance from an authorized representative, such as an attorney, Certified Public Accountant (CPA), or Enrolled Agent (EA), especially when dealing with complicated tax situations. A comprehensive guide on using this declaration can be... Fill Now

2848 IRS Form 2848, the Power of Attorney and Declaration of Representative, is a document that allows taxpayers to appoint an eligible individual to represent them in matters related to the Internal Revenue Service (IRS). This form is essential when a taxpayer needs assistance from an authorized representative, such as an attorney, Certified Public Accountant (CPA), or Enrolled Agent (EA), especially when dealing with complicated tax situations. A comprehensive guide on using this declaration can be... Fill Now -

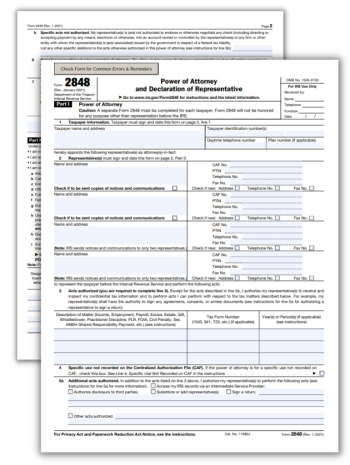

![image]() Form 2848 Instructions Embarking upon the journey of comprehending the paramountcy of IRS Form 2848 instructions, it is incumbent upon us to delve into the labyrinthine nature of this particular tax document, elucidating its objectives and potential applications in the realm of United States taxation. As an aspiring economist endeavoring to shed light on this intricate declaration, the ensuing discourse shall endeavor to meticulously expound upon the pivotal aspects to bear in mind whilst completing the form, in addition to elucidating common pitfalls taxpayers encounter and proffering sagacious counsel on circumventing these tribulations. The Quintessential Objectives and Utilization of Tax Form 2848 At the core of its raison d'être, tax form 2848 instructions serve to enlighten taxpayers on the process of designating an individual, typically a certified public accountant or attorney, as their authorized representative in matters pertaining to federal taxation. This authorization empowers the appointed individual to perform an array of tasks on the taxpayer's behalf, encompassing but not limited to negotiating with the Internal Revenue Service, signing annual returns, and receiving confidential tax documentation. The following bullet points elucidate crucial elements to consider when filling out the template: Ensure accurate and comprehensive completion of personal information, including name, address, and taxpayer identification number. Designate the specific tax matters and years for which representation is sought, avoiding any ambiguity or vagueness. Affix the required signatures of both the taxpayer and the designated representative, ascertaining the validity of the document. Retain a copy of the attorney declaration for personal records and submit the original to the appropriate IRS office. Solutions for Error-Free Completion of Form 2848 In the intricate domain of taxation, it is not uncommon for taxpayers to inadvertently make mistakes when completing forms, and instructions for IRS Form 2848 are no exception. To alleviate the likelihood of such errors and facilitate a seamless authorization process, the following list delineates typical missteps and their corresponding preventative measures: Erroneously inputting informationMeticulously verify the accuracy of all personal and tax-related data to avoid discrepancies that may hinder the authorization process. Overlooking the necessity of specifying tax mattersDiligently delineate the precise tax matters and periods for which representation is sought, ensuring a clear understanding of the scope of authorization. Submitting an unsigned 2848 formAscertain that both the taxpayer and designated representative have affixed their signatures in the appropriate sections, validating the form's legitimacy. Sending the form to the incorrect IRS officeConsult the IRS instructions for Form 2848 to determine the appropriate office to which the copy should be submitted, circumventing unnecessary delays in processing. The complexities inherent in IRS Form 2848 can be efficaciously navigated through a comprehensive understanding of its objectives and potential uses, as well as the diligent completion of the declaration and adherence to the aforementioned guidelines. By doing so, taxpayers can ensure a seamless and expeditious authorization process, empowering their designated representative to effectively handle their tax matters with the utmost competence and professionalism. Fill Now

Form 2848 Instructions Embarking upon the journey of comprehending the paramountcy of IRS Form 2848 instructions, it is incumbent upon us to delve into the labyrinthine nature of this particular tax document, elucidating its objectives and potential applications in the realm of United States taxation. As an aspiring economist endeavoring to shed light on this intricate declaration, the ensuing discourse shall endeavor to meticulously expound upon the pivotal aspects to bear in mind whilst completing the form, in addition to elucidating common pitfalls taxpayers encounter and proffering sagacious counsel on circumventing these tribulations. The Quintessential Objectives and Utilization of Tax Form 2848 At the core of its raison d'être, tax form 2848 instructions serve to enlighten taxpayers on the process of designating an individual, typically a certified public accountant or attorney, as their authorized representative in matters pertaining to federal taxation. This authorization empowers the appointed individual to perform an array of tasks on the taxpayer's behalf, encompassing but not limited to negotiating with the Internal Revenue Service, signing annual returns, and receiving confidential tax documentation. The following bullet points elucidate crucial elements to consider when filling out the template: Ensure accurate and comprehensive completion of personal information, including name, address, and taxpayer identification number. Designate the specific tax matters and years for which representation is sought, avoiding any ambiguity or vagueness. Affix the required signatures of both the taxpayer and the designated representative, ascertaining the validity of the document. Retain a copy of the attorney declaration for personal records and submit the original to the appropriate IRS office. Solutions for Error-Free Completion of Form 2848 In the intricate domain of taxation, it is not uncommon for taxpayers to inadvertently make mistakes when completing forms, and instructions for IRS Form 2848 are no exception. To alleviate the likelihood of such errors and facilitate a seamless authorization process, the following list delineates typical missteps and their corresponding preventative measures: Erroneously inputting informationMeticulously verify the accuracy of all personal and tax-related data to avoid discrepancies that may hinder the authorization process. Overlooking the necessity of specifying tax mattersDiligently delineate the precise tax matters and periods for which representation is sought, ensuring a clear understanding of the scope of authorization. Submitting an unsigned 2848 formAscertain that both the taxpayer and designated representative have affixed their signatures in the appropriate sections, validating the form's legitimacy. Sending the form to the incorrect IRS officeConsult the IRS instructions for Form 2848 to determine the appropriate office to which the copy should be submitted, circumventing unnecessary delays in processing. The complexities inherent in IRS Form 2848 can be efficaciously navigated through a comprehensive understanding of its objectives and potential uses, as well as the diligent completion of the declaration and adherence to the aforementioned guidelines. By doing so, taxpayers can ensure a seamless and expeditious authorization process, empowering their designated representative to effectively handle their tax matters with the utmost competence and professionalism. Fill Now -

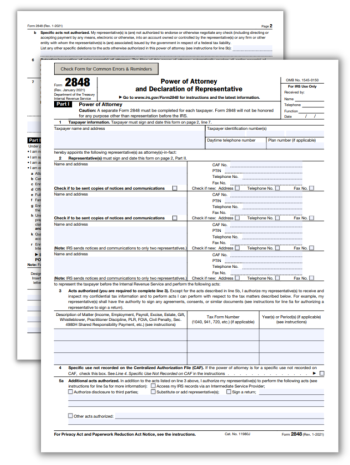

![image]() IRS Form 2848 Printable Embarking upon the labyrinthine journey of comprehending and effectively utilizing the IRS Form 2848 printable PDF, it is of paramount importance to elucidate the structural components embedded within this document, while simultaneously emphasizing the salient fields that necessitate meticulous attention. As a crucial instrument employed for the express purpose of granting power of attorney, the printable IRS Form 2848 warrants careful examination and thorough understanding to ensure seamless and accurate completion. Mastering the Art of Form 2848 Completion: A Comprehensive List of Guidelines Delving into the minutiae of the printable tax form 2848, the following bullet points elucidate the indispensable guidelines that, when adhered to with unwavering diligence, will indubitably lead to the successful accomplishment of this seemingly insurmountable task: Peruse the entirety of the template with painstaking attention, ensuring that each segment is thoroughly understood before embarking upon the actual act of completion. Ascertain the veracity of the taxpayer's personal information, including the full legal name, address, and social security number or employer identification number, as appropriate. Designate the precise tax matters for which representation is sought, including the type of tax, the tax form number, and the specific years or periods involved. Confirm the limitations, if any, on the power of attorney being granted, and document these restrictions with scrupulous precision. Guarantee the accurate completion of the representative's information, encompassing their name, address, and Centralized Authorization File (CAF) number, as well as their telephone and fax numbers. Validate the inclusion of the requisite signatures, specifically those of the taxpayer and the appointed representative, accompanied by their corresponding dates of execution. Form 2848 Filing: Navigating the Complex Path Upon the successful completion of the IRS tax form 2848 printable, the subsequent challenge of properly filing the document must be undertaken with equal enthusiasm and commitment to excellence. To facilitate this endeavor, the following enumerated steps delineate the methodical process by which this task may be consummated with ease and efficiency: Review the entirety of the completed Form 2848 to ensure that no errors or omissions have been made, rectifying any discrepancies that may be discovered. Compile any requisite supplementary documentation that may be necessary to support the assertions set forth in the Form 2848, ensuring that all pertinent materials are included. Determine the appropriate IRS office to which the completed Form 2848 and accompanying documentation must be submitted, as specified in the form's instructions. Utilize the mailing address or fax number provided in the form's instructions to transmit the completed IRS Form 2848 and all relevant supplementary materials to the designated IRS office. Retain a copy of the submitted 2848 copy and any supporting documentation for future reference, safeguarding these materials in a secure and easily accessible location. Heeding the Imminent Approach of the Form 2848 Deadline As the arduous task of completing and filing Form 2848 draws to a close, it is of critical importance to remain cognizant of the looming deadline by which this document must be submitted. While there is no specific date imposed upon the filing of Form 2848, it is strongly advised to submit the copy well in advance of any tax-related deadlines to ensure adequate time for processing and representation by the appointed individual. By adhering to this sage advice, the successful utilization of Form 2848 shall be achieved with aplomb and finesse. Fill Now

IRS Form 2848 Printable Embarking upon the labyrinthine journey of comprehending and effectively utilizing the IRS Form 2848 printable PDF, it is of paramount importance to elucidate the structural components embedded within this document, while simultaneously emphasizing the salient fields that necessitate meticulous attention. As a crucial instrument employed for the express purpose of granting power of attorney, the printable IRS Form 2848 warrants careful examination and thorough understanding to ensure seamless and accurate completion. Mastering the Art of Form 2848 Completion: A Comprehensive List of Guidelines Delving into the minutiae of the printable tax form 2848, the following bullet points elucidate the indispensable guidelines that, when adhered to with unwavering diligence, will indubitably lead to the successful accomplishment of this seemingly insurmountable task: Peruse the entirety of the template with painstaking attention, ensuring that each segment is thoroughly understood before embarking upon the actual act of completion. Ascertain the veracity of the taxpayer's personal information, including the full legal name, address, and social security number or employer identification number, as appropriate. Designate the precise tax matters for which representation is sought, including the type of tax, the tax form number, and the specific years or periods involved. Confirm the limitations, if any, on the power of attorney being granted, and document these restrictions with scrupulous precision. Guarantee the accurate completion of the representative's information, encompassing their name, address, and Centralized Authorization File (CAF) number, as well as their telephone and fax numbers. Validate the inclusion of the requisite signatures, specifically those of the taxpayer and the appointed representative, accompanied by their corresponding dates of execution. Form 2848 Filing: Navigating the Complex Path Upon the successful completion of the IRS tax form 2848 printable, the subsequent challenge of properly filing the document must be undertaken with equal enthusiasm and commitment to excellence. To facilitate this endeavor, the following enumerated steps delineate the methodical process by which this task may be consummated with ease and efficiency: Review the entirety of the completed Form 2848 to ensure that no errors or omissions have been made, rectifying any discrepancies that may be discovered. Compile any requisite supplementary documentation that may be necessary to support the assertions set forth in the Form 2848, ensuring that all pertinent materials are included. Determine the appropriate IRS office to which the completed Form 2848 and accompanying documentation must be submitted, as specified in the form's instructions. Utilize the mailing address or fax number provided in the form's instructions to transmit the completed IRS Form 2848 and all relevant supplementary materials to the designated IRS office. Retain a copy of the submitted 2848 copy and any supporting documentation for future reference, safeguarding these materials in a secure and easily accessible location. Heeding the Imminent Approach of the Form 2848 Deadline As the arduous task of completing and filing Form 2848 draws to a close, it is of critical importance to remain cognizant of the looming deadline by which this document must be submitted. While there is no specific date imposed upon the filing of Form 2848, it is strongly advised to submit the copy well in advance of any tax-related deadlines to ensure adequate time for processing and representation by the appointed individual. By adhering to this sage advice, the successful utilization of Form 2848 shall be achieved with aplomb and finesse. Fill Now -

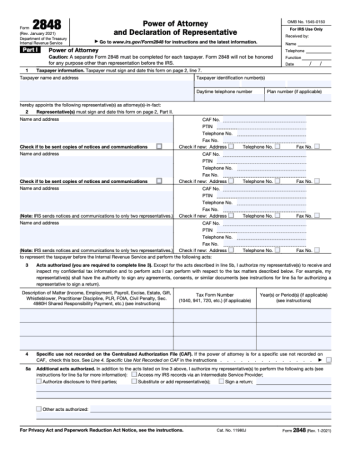

![image]() IRS Form 2848 Example In the multifaceted realm of taxation within the United States, an array of convoluted scenarios often arise, necessitating the utilization of specific tax forms. One such sample, IRS Form 2848, serves as a quintessential example of the complexity involved in the tax filing process. Delving into the depths of this particular document, this article endeavors to elucidate the numerous circumstances under which individuals may find themselves compelled to file Form 2848, while simultaneously providing feasible solutions to navigate these atypical situations. Furthermore, the subsequent sections aim to furnish readers with an extensive guide for rectifying errors made during the filing process and addressing frequently asked practical questions related to this form. IRS Form 2848 Example Scenarios and Solutions Embarking on an exploration of the labyrinthine world of taxation, the following IRS Form 2848 example scenarios demonstrate the diverse range of situations that necessitate the filing of this declaration, accompanied by viable solutions for each case: Contemplating the predicament of an individual experiencing incapacitation or debilitation, the appointment of a power of attorney via the 2848 form example becomes essential to ensure proper management of tax affairs during this period of vulnerability. In such instances, it is advisable for the individual or their legal representative to meticulously complete and submit the form, granting the designated party the authority to act on their behalf in tax-related matters Envisioning a scenario in which an individual, consumed by the demands of professional and personal life, opts to entrust their tax matters to a proficient and trustworthy tax professional, the implementation of IRS Form 2848 power attorney example serves as an ideal solution. This approach enables the appointed tax professional to handle the individual's taxes, alleviating the burden of tax management while ensuring compliance with the complex tax code. Addressing Errors and the Path to Rectification Mistakes, an intrinsic element of human nature, are prone to manifest within the intricate process of filing tax forms. In the event of an error occurring during the submission of Form 2848, the following comprehensive guide offers direction on the appropriate steps to undertake for rectification: Upon the discovery of an error, promptly notify the IRS of the issue, providing a detailed explanation of the mistake and the correct information Submit an amended Form 2848, ensuring the accurate information is included and the erroneous data rectified In cases where the error pertains to the appointed representative, swiftly communicate with the individual to discuss the issue and determine the ideal course of action for resolution. Practical FAQ for Form 2848 What is the primary purpose of filing Form 2848?The primary purpose is to appoint a power of attorney, granting an individual or entity the authority to act on one's behalf in tax-related matters. How can an appointed representative's authority be revoked?To revoke the authority of a representative, complete a new Form 2848, indicating the revocation in the "Acts Authorized" section, and submit it to the IRS. Are there any specific qualifications required for an individual to be appointed as a power of attorney via Form 2848?The appointed representative must be an eligible individual, such as an attorney, certified public accountant, or enrolled agent authorized to practice before the IRS. With the information and guidance provided within this article, navigating the convoluted realm of tax form 2848 becomes a more manageable and comprehensible endeavor, empowering individuals to address their tax-related needs with confidence and proficiency effectively. Fill Now

IRS Form 2848 Example In the multifaceted realm of taxation within the United States, an array of convoluted scenarios often arise, necessitating the utilization of specific tax forms. One such sample, IRS Form 2848, serves as a quintessential example of the complexity involved in the tax filing process. Delving into the depths of this particular document, this article endeavors to elucidate the numerous circumstances under which individuals may find themselves compelled to file Form 2848, while simultaneously providing feasible solutions to navigate these atypical situations. Furthermore, the subsequent sections aim to furnish readers with an extensive guide for rectifying errors made during the filing process and addressing frequently asked practical questions related to this form. IRS Form 2848 Example Scenarios and Solutions Embarking on an exploration of the labyrinthine world of taxation, the following IRS Form 2848 example scenarios demonstrate the diverse range of situations that necessitate the filing of this declaration, accompanied by viable solutions for each case: Contemplating the predicament of an individual experiencing incapacitation or debilitation, the appointment of a power of attorney via the 2848 form example becomes essential to ensure proper management of tax affairs during this period of vulnerability. In such instances, it is advisable for the individual or their legal representative to meticulously complete and submit the form, granting the designated party the authority to act on their behalf in tax-related matters Envisioning a scenario in which an individual, consumed by the demands of professional and personal life, opts to entrust their tax matters to a proficient and trustworthy tax professional, the implementation of IRS Form 2848 power attorney example serves as an ideal solution. This approach enables the appointed tax professional to handle the individual's taxes, alleviating the burden of tax management while ensuring compliance with the complex tax code. Addressing Errors and the Path to Rectification Mistakes, an intrinsic element of human nature, are prone to manifest within the intricate process of filing tax forms. In the event of an error occurring during the submission of Form 2848, the following comprehensive guide offers direction on the appropriate steps to undertake for rectification: Upon the discovery of an error, promptly notify the IRS of the issue, providing a detailed explanation of the mistake and the correct information Submit an amended Form 2848, ensuring the accurate information is included and the erroneous data rectified In cases where the error pertains to the appointed representative, swiftly communicate with the individual to discuss the issue and determine the ideal course of action for resolution. Practical FAQ for Form 2848 What is the primary purpose of filing Form 2848?The primary purpose is to appoint a power of attorney, granting an individual or entity the authority to act on one's behalf in tax-related matters. How can an appointed representative's authority be revoked?To revoke the authority of a representative, complete a new Form 2848, indicating the revocation in the "Acts Authorized" section, and submit it to the IRS. Are there any specific qualifications required for an individual to be appointed as a power of attorney via Form 2848?The appointed representative must be an eligible individual, such as an attorney, certified public accountant, or enrolled agent authorized to practice before the IRS. With the information and guidance provided within this article, navigating the convoluted realm of tax form 2848 becomes a more manageable and comprehensible endeavor, empowering individuals to address their tax-related needs with confidence and proficiency effectively. Fill Now -

![image]() IRS Form 2848 PDF As an individual embarking upon the convoluted realm of taxation in the United States, it is of utmost importance to elucidate the intricacies surrounding the Internal Revenue Service's (IRS) Form 2848. This particular document, colloquially referred to as the "Power of Attorney and Declaration of Representative" form, warrants meticulous attention due to its pivotal role in the designation of an authorized representative to act on one's behalf in tax-related matters. In the labyrinthine world of taxation documentation, a dichotomy exists between printable and fillable versions of IRS Form 2848 PDF. This article shall endeavor to dissect the pros and cons of each iteration and expound upon the circumstances in which electronic submission may prove advantageous. IRS Form 2848 Fillable PDF: Unraveling the Benefits & Drawbacks Form 2848 Fillable PDF possesses a myriad of advantages for those individuals inclined to embrace the digital revolution. Among the multitude of benefits, one may enumerate the following: Enhanced legibility due to typed entries Facilitation of error detection and correction Elimination of superfluous printing and mailing costs Expedited processing times Notwithstanding the aforementioned advantages, it is incumbent upon the aspirant economist to acknowledge the potential drawbacks associated with the fillable PDF variant of IRS Form 2848. These may encompass: Requirement for specialized software to edit and save the document Potential privacy concerns regarding electronic storage of sensitive information Technical difficulties that may impede completion or submission of the sample IRS Form 2848 Printable PDF: Dissecting the Pros and Cons Conversely, the IRS Form 2848 Printable PDF embodies its own unique set of advantages and disadvantages. The simplicity of utilizing a hard copy document may appeal to those averse to digital processes, and the benefits thereof may include: No requirement for specialized editing software Greater control over the physical security of sensitive information Accessibility for those with limited digital literacy However, the printable iteration of the 2848 Power of Attorney PDF is not without its limitations, which may incorporate: Increased likelihood of illegible or erroneous entries Additional time and resources required for printing and mailing Potential delays in processing due to manual submission Discerning the Optimal Circumstances for Electronic Submission of IRS Form 2848 Having elucidated the pros and cons of each variant of IRS Form 2848, it is now incumbent upon the reader to determine the most propitious circumstances for filing the template electronically. The digital submission of the copy may prove advantageous in instances where: Time is of the essence, necessitating expedited processing Accuracy and legibility are paramount Cost-effectiveness is a primary consideration Environmental consciousness is a motivating factor In conclusion, the decision to utilize the fillable or printable version of IRS Form 2848 is contingent upon a multitude of factors, including individual preferences, technical capabilities, and specific tax-related circumstances. By carefully weighing the advantages and disadvantages of each option, taxpayers and their designated representatives can make informed decisions that best serve their unique needs. Fill Now

IRS Form 2848 PDF As an individual embarking upon the convoluted realm of taxation in the United States, it is of utmost importance to elucidate the intricacies surrounding the Internal Revenue Service's (IRS) Form 2848. This particular document, colloquially referred to as the "Power of Attorney and Declaration of Representative" form, warrants meticulous attention due to its pivotal role in the designation of an authorized representative to act on one's behalf in tax-related matters. In the labyrinthine world of taxation documentation, a dichotomy exists between printable and fillable versions of IRS Form 2848 PDF. This article shall endeavor to dissect the pros and cons of each iteration and expound upon the circumstances in which electronic submission may prove advantageous. IRS Form 2848 Fillable PDF: Unraveling the Benefits & Drawbacks Form 2848 Fillable PDF possesses a myriad of advantages for those individuals inclined to embrace the digital revolution. Among the multitude of benefits, one may enumerate the following: Enhanced legibility due to typed entries Facilitation of error detection and correction Elimination of superfluous printing and mailing costs Expedited processing times Notwithstanding the aforementioned advantages, it is incumbent upon the aspirant economist to acknowledge the potential drawbacks associated with the fillable PDF variant of IRS Form 2848. These may encompass: Requirement for specialized software to edit and save the document Potential privacy concerns regarding electronic storage of sensitive information Technical difficulties that may impede completion or submission of the sample IRS Form 2848 Printable PDF: Dissecting the Pros and Cons Conversely, the IRS Form 2848 Printable PDF embodies its own unique set of advantages and disadvantages. The simplicity of utilizing a hard copy document may appeal to those averse to digital processes, and the benefits thereof may include: No requirement for specialized editing software Greater control over the physical security of sensitive information Accessibility for those with limited digital literacy However, the printable iteration of the 2848 Power of Attorney PDF is not without its limitations, which may incorporate: Increased likelihood of illegible or erroneous entries Additional time and resources required for printing and mailing Potential delays in processing due to manual submission Discerning the Optimal Circumstances for Electronic Submission of IRS Form 2848 Having elucidated the pros and cons of each variant of IRS Form 2848, it is now incumbent upon the reader to determine the most propitious circumstances for filing the template electronically. The digital submission of the copy may prove advantageous in instances where: Time is of the essence, necessitating expedited processing Accuracy and legibility are paramount Cost-effectiveness is a primary consideration Environmental consciousness is a motivating factor In conclusion, the decision to utilize the fillable or printable version of IRS Form 2848 is contingent upon a multitude of factors, including individual preferences, technical capabilities, and specific tax-related circumstances. By carefully weighing the advantages and disadvantages of each option, taxpayers and their designated representatives can make informed decisions that best serve their unique needs. Fill Now